days sales in inventory ratio interpretation

Cash Flow Coverage Ratio Operating Cash Flows Total Debt. Ratio analysis is used to.

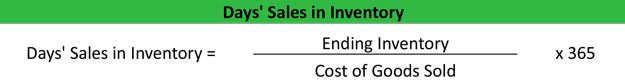

Days Sales Of Inventory Dsi Definition

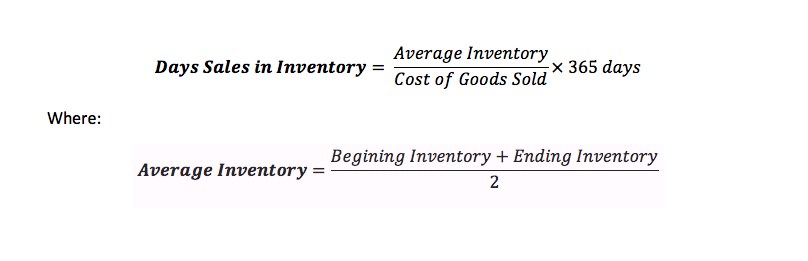

PG HA Average days inventory in stock 365 Inventory turnover Average number of days inventory held until sold.

. Days Sales Outstanding Formula. Interpretation of the Ratio. You can also use our Receivable Turnover Ratio Calculator.

A low turnover figure indicates that a business has an excessive investment in inventory and therefore is at risk of having obsolete inventory. PG HA Inventory turnover Cost of goods sold COGS Average total inventory Liquidity of inventory Benchmark. It considers the days inventory outstanding days sales outstanding and days payable.

The CDR for company B is 29 days and 365 days for company A. While Company B has higher trade creditors at the year-end it also has a higher cost of sales. Days Payable Outstanding Analysis Interpretation.

As a result Company B has a smaller CDR or DPO ratio. Payable turnover ratio interpretation. DSO Accounts ReceivablesNet Credit SalesRevenue 365.

Now lets see an example of this calculation at work. The Days Sales Outstanding formula to calculate the average number of days companies take to collect their outstanding payments is. A ratio analysis is a quantitative analysis of information contained in a companys financial statements.

Efficiency ratio example inventory turnover turnover ratio and days sales in inventory refer to how well the company generates sales and maximises profits while using its assets to liabilities. Empirical Literature Review Firm performances have received numerous attempt by scholars and researchers in the field of business but evidence-based literature on inventory management on firm performance in listed manufacturing firms in Ghana is rare. Another way to figure cash flow coverage ratio is to add in depreciation and amortization to earnings before interest and taxes EBIT first.

Let us consider the following Days Sales Outstanding example to understand the concept better. Also called the average collection period accounts receivableaverage sales per day this ratio allows financial managers to evaluate the efficiency with which the firm is. Receivables needed to maintain firms sales level.

The average collection period is the approximate amount of time that it takes for a business to receive payments owed in terms of accounts receivable. The inventory turnover ratio number of days of inventory ratio and gross profit margin ratio are useful in evaluating the management of a companys inventory. A receivable turnover ratio of 2 would give an average collection period of 6 Months 12 Months 2 and similarly 6 would give 2 Months 12 Months 6.

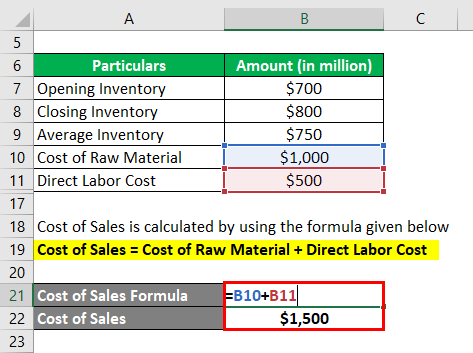

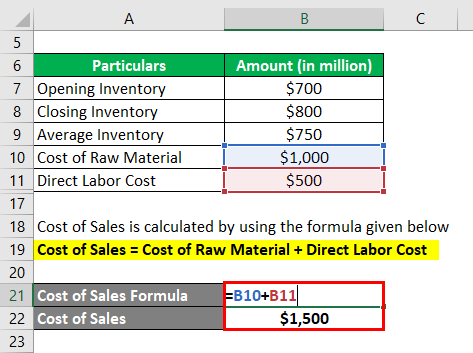

Inventory management may have a substantial impact on a companys activity profitability liquidity and solvency ratios. Average number of days until AR collected. Hence for the sake of convenience analysts generally use the Cost of Sales or Cost of Goods SoldCOGS as a proxy for Credit Purchases.

The inventory turnover ratio allows the financial manager to determine if the firm is stocking out of inventory or holding obsolete inventory. Here we discuss formula to calculate Days Payable Outstanding its interpretation practical industry examples. The meaning is quite clear.

Average Collection Period. A ratio of 1 is usually considered the middle ground. This is known as the inventory turnover period.

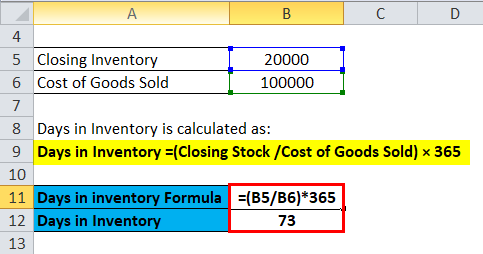

Calculates the proportion of net profit to sales. Is a ratio analysis measure to evaluate the number of days or time a company converts its inventory and other inputs into cash. You can also divide the result of the inventory turnover calculation into 365 days to arrive at days of inventory on hand which may be a more understandable figure.

A low proportion can indicate a bloated cost structure or. A WCR of 1 indicates the current assets equal current liabilities. Facebook Share on linkedin.

Also consider the below-given Balance Sheet extract of Walmart. Thus a turnover rate of 40 becomes 91 days of inventory. Since the working capital ratio measures current assets as a percentage of current liabilities it would only make sense that a higher ratio is more favorable.

Cash Flow Coverage Ratio EBIT depreciation amortization Total Debt. With diverse views of concentration of study and explanatory variables this research is geared toward. The receivables turnover ratio is an absolute figure normally between 2 to 6.

So what does that mean in practice. Problems with the Inventory Turnover Formula. Calculates the time it takes to sell off inventory.

Coverage ratios for example debt-service coverage ratio and times interest earned ratio measure the ability of a company to make interest.

Days Sales In Inventory Dsi Formula And Calculator Excel Template

Inventory Turnover Ratio Days Sales In Inventory The Two Restaurant Inventory Metrics That Will Help You Squash Food Cost Maximize Profits Apicbase

Days Sales In Inventory Definition Formula Calculated Example Analysis

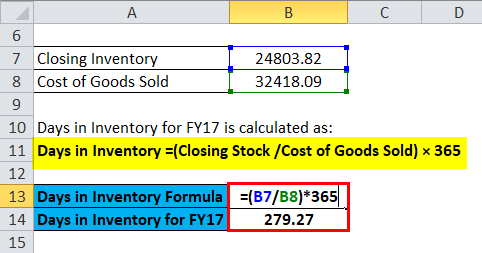

Days In Inventory Formula Calculator Excel Template

Days In Inventory Formula Calculator Excel Template

Inventory Days Formula Meaning Example And Interpretation

Inventory Days Formula How To Calculate Days Inventory Outstanding

Inventory Days Double Entry Bookkeeping

Days Sales Outstanding Dso Formula And Calculator Excel Template

Days Sales Outstanding Formula Meaning Example And Interpretation

Days Inventory Outstanding Dio Formula And Calculator Excel Template

Days Sales In Inventory Dsi Overview How To Calculate Importance

Days In Inventory Top 3 Examples Of Days In Inventory

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Inventory Days Formula Meaning Example And Interpretation

Inventory Days Formula Meaning Example And Interpretation

/terms-i-inventoryturnover.asp_final-3cb0931e6efa4680a0d71166192395ed.png)